As the IXOPAY payment orchestration platform celebrates its 10th anniversary this year, we look back at how the payments landscape has changed in that time. Thomas has been working in the payments industry for several decades, and looks at the emergence of payment orchestration and how a proliferation of payment methods has reshaped the industry.

I’ve been working in payments for many years, and it is a fast-moving market. 10 years ago, when IXOPAY was born, I was working at an acquirer. The payments landscape back then was totally different. One of the most important use cases - at least in Austria - was mobile billing. What started out being primarily used to purchase ringtones, ended up being ubiquitous for small payments, such as paying for parking. Nowadays everything is simply handled via an app!

Ecommerce was still establishing itself, although certain markets were already firmly entrenched online - especially high risk activities such as adult entertainment and gambling. These industries were ahead of the curve, and as well as devising the initial concept of payment orchestration, gambling was one of the first major industries to see the introduction of alternative payment methods. These were pioneered by vendors such as Skrill and Neteller, who offered dedicated payment methods for online gambling that were precursors of today’s digital wallets. You could go into a newsagents to buy a 16-digit code that could be redeemed online, much like Amazon and Steam gift cards today.

When ecommerce was just getting started, almost all merchants were operating with a single PSP. That PSP would typically offer multiple payment methods, but the concept of payment orchestration - where a merchant can connect to multiple PSPs - was restricted to the high risk merchants, who had created their own internal solutions. This allowed them to easily switch to a new PSP - a key business requirement for merchants who would frequently find their contracts with providers being terminated for one reason or another. The idea that merchants in other industries faced the same risk only really entered the public consciousness recently, with the demise of Wirecard. With many businesses suddenly unable to process payments overnight, it perfectly illustrated the risks of relying on a single payment provider for all merchants, not just those in high risk markets.

The Proliferation of Alternative Payment Methods Reshaped the Industry

The proliferation of alternative payment methods - many of which are regional - has been another factor driving the adoption of payment orchestration. Merchants quickly understood that the overheads that came with implementing new methods as they arose and gained popularity were taking away resources from their core business activities. While you could rely on an in-house implementation when you only had one provider to deal with, this approach was becoming less and less feasible, particularly as ecommerce went global. Merchants were suddenly facing a very different challenge, in stark contrast to the times when offering one or two alternatives to credit cards was sufficient. Here in Austria, you would typically have been offered credit cards, bank transfers and maybe PayPal. Suddenly, that was not enough.

This more complex payments landscape led to a number of changes across the industry, and that change is still ongoing today. We see far more payment providers as a result of the expanding number of payment methods, some of whom have become household names like Stripe. Back in the early days, no consumer had ever heard of the companies that were involved in processing payments.

Convenience Matters

With payments becoming more complex, we have also seen the rise of the Head of Payments at merchants - this is absolutely crucial now that ecommerce has finally come of age. There’s much more to payments than simply processing a transaction, something I had to learn the hard way myself. It’s not until you go live that you realize the problems you are facing. In the case of payments, one of the unkind surprises I faced - as have many other merchants - was that processes can quickly get inefficient when you are dealing with multiple providers. Once a transaction has been processed, it still needs to go through the settlement and reconciliation processes, as well as be exported to external systems. With every PSP using its own data format, streamlining these processes has become its own science - something that IXOPAY makes so much easier. I have many personal horror stories I could share about what happens when these processes are not automated and files need to be downloaded and imported manually. But thankfully, those days are over!

But it’s not just the technology behind payments processing that has changed over the past decade. There is no denying the impact of the smartphone revolution. An online store used to be nothing more than a nice-to-have for most merchants. But the smartphone - and of course COVID - really changed the way ecommerce is perceived by the general public. With stores closed because of the pandemic, consumers were forced to turn to ecommerce for their shopping needs, and they soon discovered the convenience benefits. Convenience really matters to consumers! And smartphones are convenient too. With everything running on smartphones these days, merchants have needed to pivot accordingly.

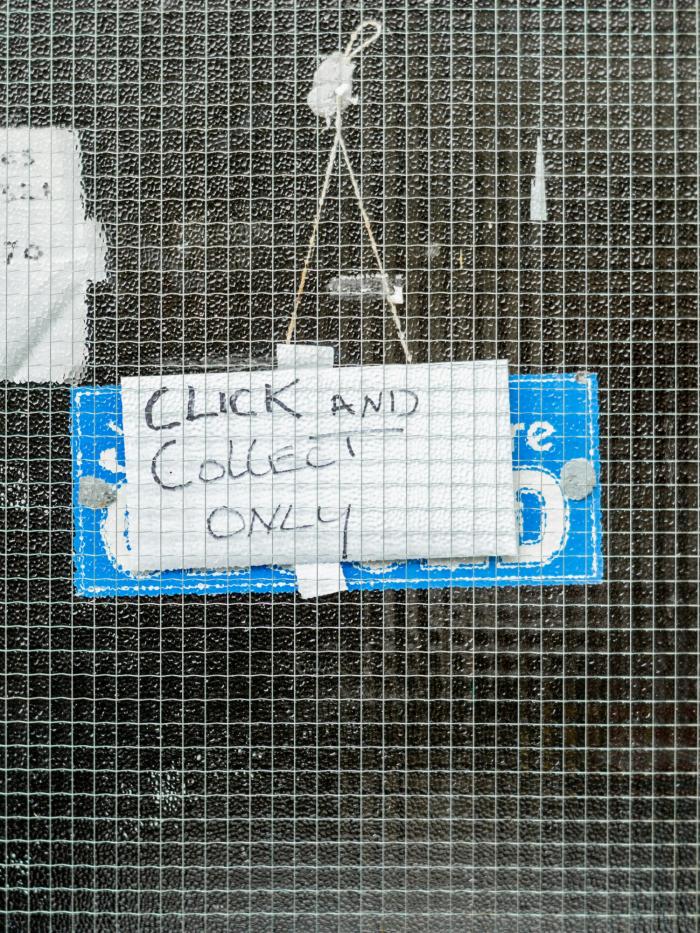

The smartphone isn’t all benefits though. The small form factor and the fact that most users are running apps rather than shopping in a browser means that merchants need to integrate the payment methods that consumers want to use directly within the app. Gone are the days when opening a browser window on a smartphone was deemed acceptable. Everything needs to be handled within the app, as seamlessly as possible. Because once again, convenience matters!