Buy Now, Pay Later is firmly established as a popular payment option. This is especially true for millennials, who are the most likely to use BNPL to pay for essentials like groceries and other household bills. This popularity and the expectation among customers for BNPL to be an option at checkout means that many merchants consider it a necessity. However, legislators have increasingly been identifying BNPL as an area of concern, resulting in changes to regulations.

What is BNPL?

Buy Now, Pay Later (BNPL) is a form of short-term financing at the point-of-sale. With BNPL, consumers typically pay a small amount upfront and then pay off the remaining balance in a series of installments. As long as consumers meet their payment obligations on time, most BNPL schemes are interest free. They thus offer consumers a degree of flexibility, spreading out the cost of a purchase while avoiding high interest rates typical with credit cards.

How does BNPL work?

When a customer chooses to pay via BNPL, they enter into an agreement with the BNPL provider to cover the costs of the purchase over a series of installments. The BNPL provider pays the merchant for the purchase up-front in return for a commission. Merchants can thus immediately access these funds, while the consumer repays the BNPL provider, not the merchant. This protects merchants from the risk of fraud, chargebacks or consumers defaulting on payments - these are instead risks assumed by the BNPL provider.

The Risks of BNPL

The vast majority of consumers use BNPL without issues, meeting their payment obligations on time. However, some consumers end up taking out BNPL loans they cannot afford to repay. This has become exacerbated by the cost of living crisis, which has led to BNPL being used to complete purchases of essential goods and cover basic household expenses. The penalties for missed payments can be high, leading to the financially vulnerable being drawn into a debt spiral. This is particularly true for millennials - this demographic is not only the most likely to use BNPL, but also the most likely to default on repayments.

56% of millennials in the US use interest free payments over multiple installments, according to Statista. Over a 12 month period, 14% of millennials were hit with additional costs for failing to meet their obligations. Figures for Gen Z are similar: 49% have used these services and 11% had difficulties making repayments over a 12 month period. The data for other countries is similar, and this has resulted in a lot of media coverage of BNPL over the past years.

Tightening Legislation

This risk to consumers has led to governments around the world reviewing and overhauling legislation. For example, many BNPL providers have benefited from exemptions for low value loans with 0% interest rates. While different jurisdictions are taking different approaches, the overall trend is towards additional oversight, including the requirement for credit checks before issuing these loans.

The UK introduced new requirements for lenders to carry out affordability checks on BNPL and other short term interest free loans. Furthermore, lenders who offer these products will need to be approved by the Financial Conduct Authority (FCA). The terms and conditions must be made clear in any promotional material, and consumers will be able to take complaints relating to these services to the Financial Ombudsman Service (FOS). However, this may turn out to be a blessing in disguise for BNPL providers. Roughly half a year prior to the announcement of these new requirements, 37% of respondents to a Statista consumer survey stated that they would not consider using BNPL at all - most likely in part as a result of recent negative press coverage.

The EU has responded by revising the Consumer Credit Directive to also cover BNPL offerings. New credit rules apply to loans below a value of EUR 200 of interest free credit, which were previously exempted. Similar to the UK, information directed at consumers in advertising and contracts will be regulated to ensure consumers are well informed, and pre-ticked boxes will no longer be permitted. Before a consumer can sign up for a BNPL product, lenders will also be required to assess the consumer’s credit worthiness and ensure the consumer’s ability to repay the loan.

In the US, the Consumer Financial Protection Bureau issued a report on BNPL in 2023, outlining areas where BNPL is potentially detrimental to consumers. Areas of concern highlighted in the report included the lack of standardized disclosures, unsatisfactory rights to resolve disputes, and the potential for BNPL to cause consumers to overextend their lines of credit. With BNPL borrowers already more likely to be heavily indebted, there is a significant risk of them being unable to meet repayment obligations. BNPL lenders in California are already subject to rules and regulations, with BNPL products considered loans. This means that BNPL providers must be licensed accordingly. Other states are monitoring the situation, which may result in a patchwork of regulations that differ between jurisdictions.

Impact on Merchants

These legislative changes will impact how BNPL payments can be offered. However, the onus is on BNPL providers to change the way they operate, and merchants themselves will only be impacted indirectly. For example, credit checks to determine the ability of consumers to repay loans could lead to a decline in the number of consumers approved for BNPL at checkout. Merchants are thus more likely to experience payment failures, with a small portion of consumers having their BNPL application rejected by the providers. This may have an effect on merchants’ bottom lines, especially those that previously relied heavily on BNPL as a payment method.

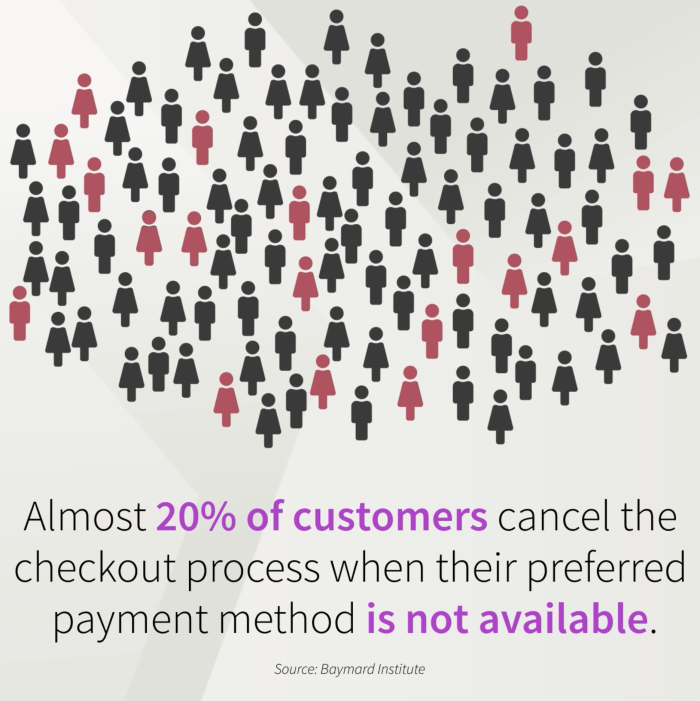

Nonetheless, merchants can - and should - continue to offer BNPL to consumers. Many shoppers actively look for this payment option, which is already well-established and thus has come to be expected. Cart abandonment is far more likely if consumers are unable to use their preferred payment method. In order to cater to different consumer preferences, merchants should look to offer a wide variety of payment options that cater to different target demographics. This not only reduces the risk of cart abandonment, but also allows consumers to fall back on other payment methods if necessary. A consumer who is denied a BNPL loan can thus still complete their purchase as long as they have access to another payment method supported by the merchant. This approach is already commonplace - if a credit card transaction is rejected, it makes sense to offer consumers an alternative (bank transfer, PayPal etc.). This applies just as much to BNPL as to any other payment method.

Of course, offering consumers a choice of payment options at checkout brings its own challenges. This is particularly true for merchants operating in multiple regions, given that consumer preferences and providers vary significantly between countries. The IXOPAY payment orchestration platform integrates a wide variety of BNPL payment methods alongside other payment options, including credit cards, bank transfers, and both global and local alternative payment methods. With all payment providers integrated via the same API, merchants can easily offer all popular payment methods in the consumer’s region. This plays a key role in maximizing conversion rates and offering consumers alternative payment options if their preferred method is declined.

If you would like to offer your customers access to local BNPL payment options alongside other popular payment methods, get in touch with us to find out how IXOPAY can help you deliver the payment methods your customers expect.