Key Benefits

Reduce Complexity

Eliminate the need to store payment data in multiple systems, reduce complexity, and centralize data for portability and analysis.

Minimize PCI Scope

Store token values, not card data. Since sensitive card data is kept off merchant systems, PCI scope is minimized, so you spend less time, money, and resources on audits.

Increase Flexibility

Vaulting directly with a processor restricts your business and adds dependency. Own your payment data, eliminate vendor lock-in, and easily switch or add payment processors as your business evolves.

Gain Insights

Tracking customer purchases across channels and processors is easy with all your payment data in a single location.

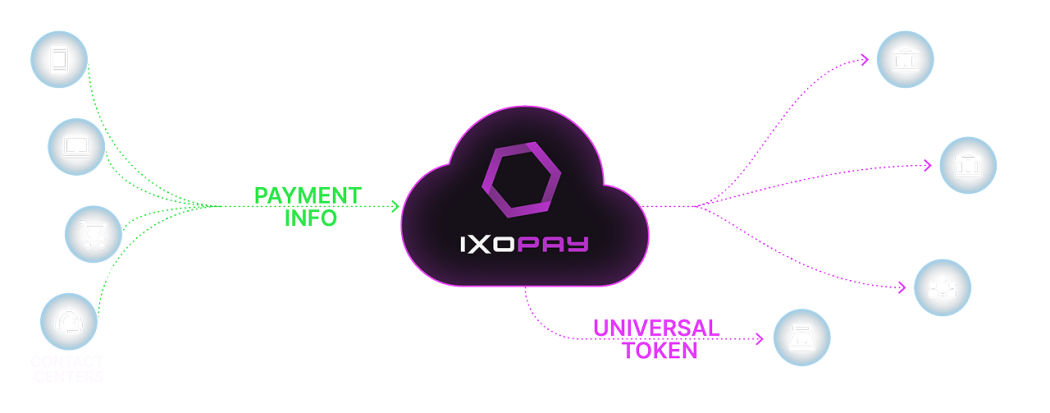

How it Works

Universal Tokens replace sensitive payment data with a non-sensitive token. This token can be used to transact across in-person and online channels and all of your payment processors. Universal Tokens provide full access to your payment data without the liability of directly accessing sensitive payment information.

What You Get

Securely Accept & Consolidate Payments Across Channels

Accept payment information across different channels, all while reducing your PCI scope and gaining flexibility and control over your payments.

With Universal Tokens, you have one payment token that spans your in-person and online channels and all your payment processors. This eliminates storing payment data in multiple systems, reduces system complexity, and improves customer data analysis.

You also minimize risk by keeping sensitive information off your company’s internal systems.

Acceptance Channels

In-person: Point-to-Point Encryption (P2PE)

Mobile App: Mobile API

File: Batch

API: Token Services API

Phone: Call Centers

Processor Compatibility and Flexibility

Send sensitive payment information to any payment processor or third-party partner, with the flexibility to easily add or change processors as needed. Optimize your authorization rates by sending transactions to the ideal processor.

Transparent Gateway

Send or receive sensitive payment card information with any payment processor, gateway, or API endpoint

Save development time by leveraging existing API integrations

Payment Services

Pre-built connections to popular payment gateways

Save development time with a single API integration for multiple payment gateways

“We never touch any payment data in our contact centers, retail stores, websites, or in the field. That’s a big relief.”